Personal finance for beginners can feel overwhelming — especially when there’s so much conflicting advice online, and according to the Federal Reserve, many Americans struggle with emergency savings.

Some people say you need to invest immediately. Others say you should focus on saving first. And everywhere you look, there’s a new “secret” strategy to get rich fast.

At FluentMoney, we keep things simple:

Personal finance is not about perfection.

It’s about building a strong foundation, one step at a time.

This guide to personal finance for beginners will walk you through the key basics of personal finance so you can feel confident, informed, and in control of your money.

Personal Finance for Beginners: What It Really Means

Personal finance is simply how you manage your money in everyday life.

It includes:

- How much you earn

- How much you spend

- How much you save

- How you invest

- How you plan for the future

This isn’t just for experts or wealthy people — personal finance is for beginners too.

Step 1: Understand Where Your Money Is Going

Before you can improve your finances, you need clarity.

The first rule of money is:

You can’t manage what you don’t measure.

Start by tracking your spending for the past 30 days.

Look at:

- Rent or housing

- Food and groceries

- Subscriptions

- Transportation

- Shopping

- Debt payments

Most people are surprised by where their money actually goes.

Quick Tip

A simple budgeting app or even a spreadsheet is enough to start.

Step 2: Build a Budget That Works

A budget isn’t about restriction, but it’s something essential in order to learn about personal finance for beginners.

A good budget is a plan that helps you spend intentionally.

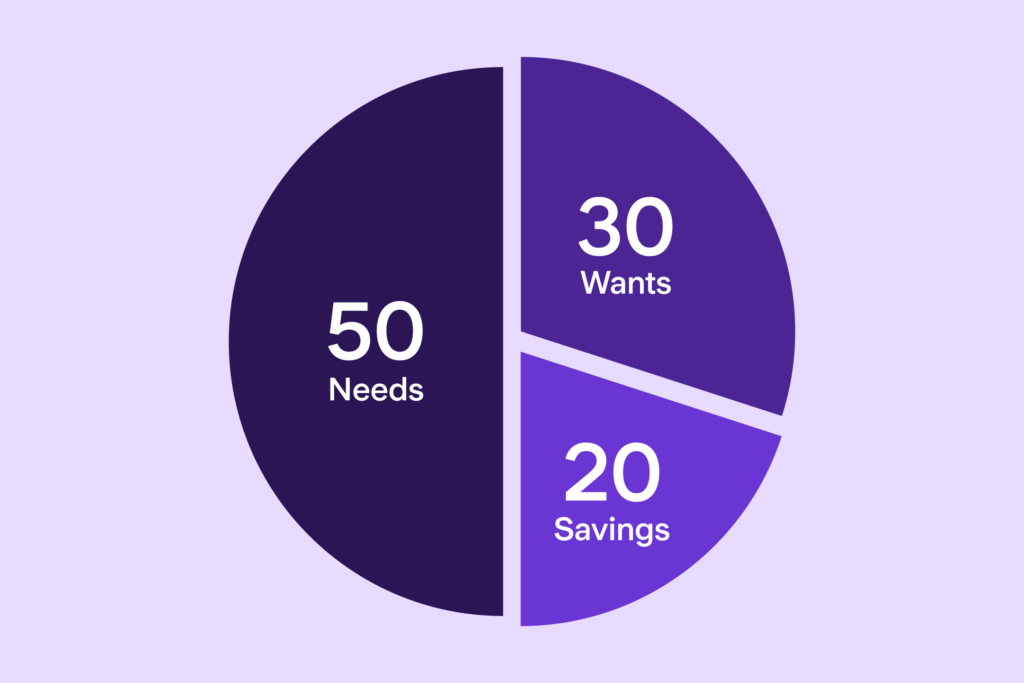

One of the easiest systems is the 50/30/20 rule:

- 50% Needs (rent, bills, groceries)

- 30% Wants (fun, eating out, hobbies)

- 20% Savings + Debt payoff

This gives structure without feeling extreme.

Step 3: Start an Emergency Fund

An emergency fund is money set aside for unexpected expenses, like:

- car repairs

- medical bills

- job loss

- urgent travel

Without an emergency fund, life surprises often turn into debt.

A good starter goal is:

- $500–$1,000 first

Then build toward: - 3–6 months of living expenses

Keep this money somewhere safe, like a high-yield savings account.

Step 4: Pay Off High-Interest Debt

Debt isn’t always bad, but high-interest debt is one of the biggest barriers to financial progress.

Focus first on:

- credit card debt

- payday loans

- high-interest personal loans

Two popular payoff strategies:

Avalanche Method

Pay off highest interest first (mathematically fastest).

Snowball Method

Pay off smallest balance first (motivational wins).

The best method is the one you can stick with.

Step 5: Start Investing (Even Small Amounts)

Investing is how you build wealth over time.

The goal isn’t to get rich overnight — it’s long-term growth.

A beginner-friendly investing path looks like:

- Start with retirement accounts if available

- Use diversified index funds

- Invest consistently over time

You don’t need thousands of dollars to begin.

Many platforms let you start with $50–$100.

Step 6: Protect Your Financial Future

Personal finance isn’t just about today — it’s about stability.

Once you have the basics in place, focus on:

- insurance coverage

- retirement planning

- building multiple income streams

- avoiding lifestyle inflation

The strongest financial strategy is consistency.

Step 7: Stay Aware of Financial Trends (Without Panic)

Money trends are always changing:

- inflation

- interest rates

- stock market swings

- crypto hype

- new side hustle waves

FluentMoney helps explain these trends clearly so you understand:

- what’s happening

- why it matters

- what you should do next

Not every headline requires action — but financial awareness is powerful.

The FluentMoney Roadmap (Simple Order)

If you want a clear step-by-step plan, follow this order:

- Track your spending

- Create a basic budget

- Build a starter emergency fund

- Pay off high-interest debt

- Start investing consistently

- Grow income over time

- Keep learning and adapting

That’s it. No gimmicks.

Final Thoughts

Personal finance doesn’t need to be complicated.

You don’t need to be perfect.

You just need to start.

Small, consistent actions lead to big financial changes over time.

FluentMoney is here to help you become confident with money — one step at a time.

Next Steps

If you’re new here, start with these upcoming FluentMoney guides: