Budgeting is one of those personal finance topics that everyone talks about… but few people actually stick with, so it’s important to learn how to build a budget that actually works.

Maybe you’ve tried budgeting before and it felt like:

- too restrictive

- too complicated

- impossible to maintain

The truth is:

A budget only works if it fits your real life.

In this guide, FluentMoney will walk through a simple, realistic way to build a budget that you can actually follow — without stress or perfection.

What Is a Budget (Really)?

A budget is not a punishment.

A budget is simply:

A plan for where your money goes before it disappears.

It helps you:

- pay bills on time

- stop overspending

- save consistently

- reach financial goals faster

How to Build a Budget That Actually Works in 9 Steps:

Step 1: Know Your Monthly Income

Start with one number:

How much money do you bring in each month?

Include:

- paycheck income (after taxes)

- freelance or side hustle income

- any consistent extra sources

If your income varies, take an average of the last 3–6 months.

Step 2: Track Your Spending First

Before you create a budget, you need awareness.

Look back at the last 30 days and write down what you spent in categories like:

- housing

- groceries

- transportation

- subscriptions

- eating out

- shopping

- debt payments

Most budgeting problems come from guessing instead of tracking.

Step 3: Start With the 3 Main Budget Categories

To keep budgeting simple, break spending into 3 buckets:

Needs

Essentials you must pay for:

- rent/mortgage

- groceries

- utilities

- insurance

Wants

Non-essentials:

- restaurants

- entertainment

- shopping

Financial Goals

Your future:

- savings

- investing

- debt payoff

This framework keeps your budget realistic.

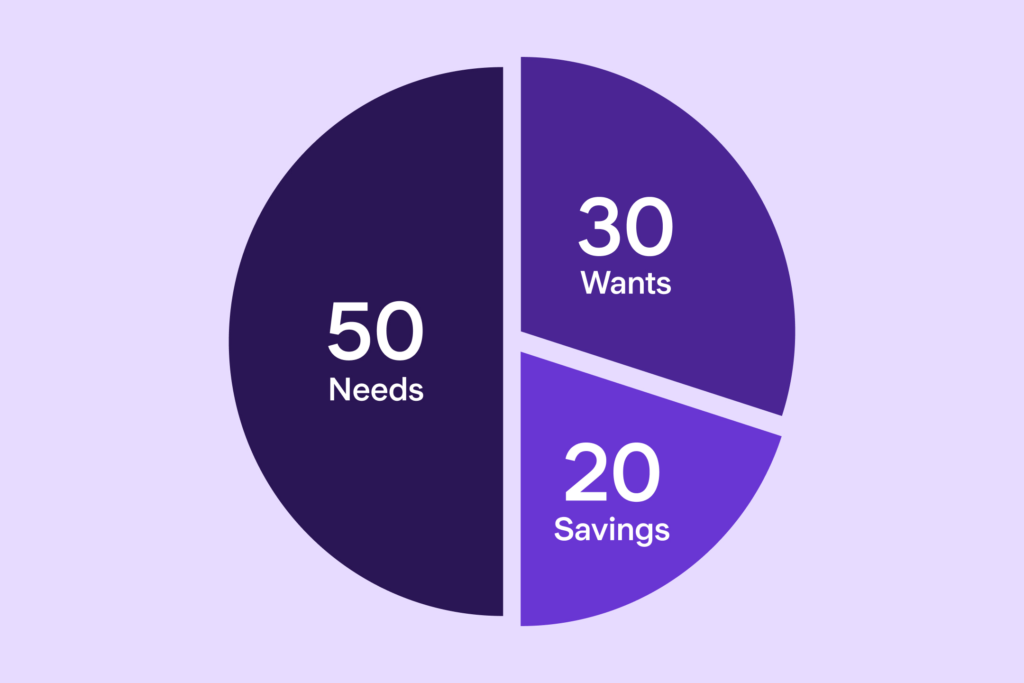

Step 4: Use the 50/30/20 Rule (Beginner-Friendly)

One of the easiest budgeting methods for learning how to build a budget that actually works is:

The 50/30/20 Budget Rule

- 50% Needs

- 30% Wants

- 20% Savings + Debt

Example:

If you earn $3,000/month:

- $1,500 → Needs

- $900 → Wants

- $600 → Savings/debt

This is a great starting point — not a strict law.

Step 5: Focus on One Goal at a Time

A budget becomes powerful when it supports a goal.

Choose one main priority, such as:

- building an emergency fund

- paying off credit card debt

- saving for a house

- investing consistently

Trying to do everything at once often leads to burnout.

Emergency Fund Explained: How Much You Need

Step 6: Make It Easy to Maintain

The best budget is the one you’ll actually follow.

Keep it simple:

- use 5–7 categories max

- automate bills when possible

- review weekly, not daily

- allow room for fun

A budget that feels too strict will fail.

Step 7: Expect Imperfection (Budgeting Is Practice)

Your first budget will not be perfect.

And that’s okay.

Budgeting is like learning a skill:

- you adjust

- you improve

- you get more confident over time

Instead of quitting, ask:

- What category surprised me?

- What can I change next month?

Progress matters more than perfection.

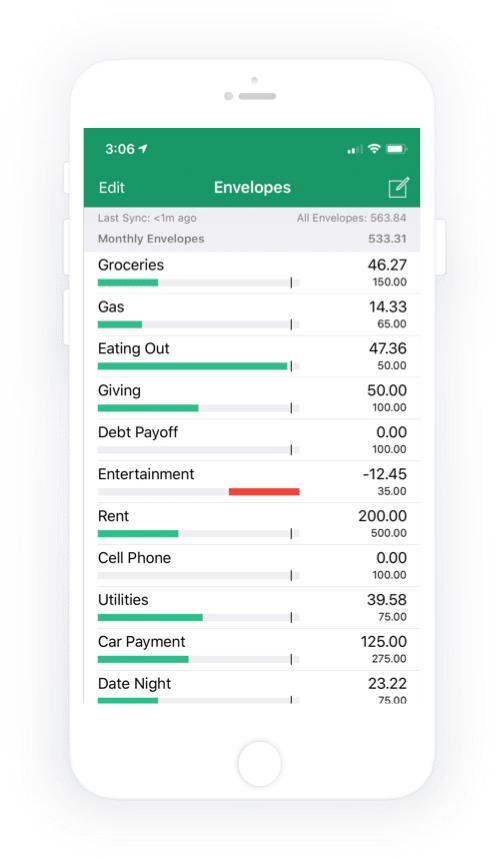

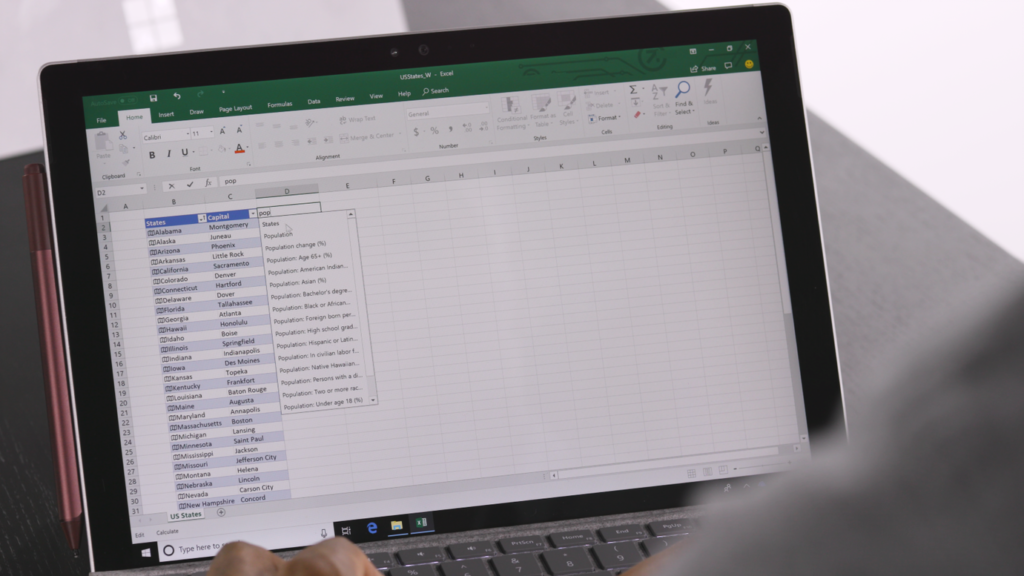

Step 8: Use Tools That Help

You don’t need fancy software, but tools can make budgeting easier.

Options:

- simple spreadsheet

- notes app

- budgeting apps like YNAB or Mint alternatives

- automatic bank tracking

Choose what fits your personality.

Step 9: Budgeting Mistakes to Avoid

Here are common reasons budgets fail:

Being too strict

Leaving no room for enjoyment.

Forgetting irregular expenses

Car repairs, gifts, annual bills.

Not tracking spending

A budget without tracking is just a guess.

Giving up after one bad month

One mistake doesn’t mean failure.

A Simple FluentMoney Budgeting Plan

If you want a straightforward starting system:

- Track last month’s spending

- List your income

- Use the 50/30/20 rule

- Automate savings

- Review weekly

- Adjust monthly

That’s it.

Final Thoughts

A budget isn’t about controlling every dollar.

It’s about creating freedom.

When you tell your money where to go, you stop wondering where it went.

Budgeting is one of the most important steps in becoming fluent with money — and FluentMoney is here to help you keep it simple.

Next FluentMoney Guides

Continue your path to building your foundation: