Investing for beginners can feel overwhelming. You might think you need thousands of dollars, a finance degree, or insider knowledge to get started.

You don’t.

In fact, investing for beginners can begin with as little as $100. The key isn’t how much you start with — it’s starting early, staying consistent, and making smart decisions.

This guide from FluentMoney will walk you through exactly how to invest your first $100 step by step.

Why Investing for Beginners Should Start Now

The biggest advantage beginner investors have isn’t money — it’s time.

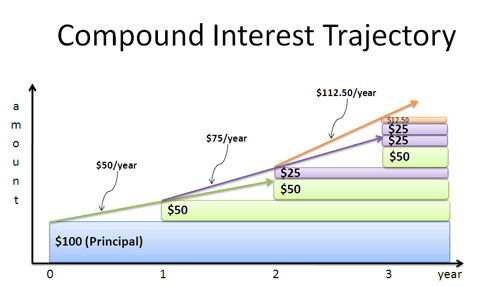

Thanks to compound growth, even small amounts can grow significantly over the years. The earlier you invest, the more time your money has to multiply.

According to the U.S. Securities and Exchange Commission (SEC), compound returns allow investors to earn returns on both their original investment and past earnings over time (SEC explanation of compound interest).

Here’s a simple example:

- Invest $100 today.

- Earn an average 8% annual return.

- Leave it invested and continue adding small amounts.

- Over decades, that $100 can grow many times over.

The lesson: Starting small is better than waiting for the “perfect” moment.

Step 1: Build a Quick Financial Foundation First

Before you invest your $100, make sure you:

- Have basic monthly expenses covered

- Avoid high-interest credit card debt

- Have at least a small emergency cushion ($500–$1,000)

If you’re still working on this, check out:

Related guide on FluentMoney: Emergency Fund Explained

Related guide on FluentMoney: How to Build a Budget That Actually Works

Investing for beginners works best when your financial base is stable.

Step 2: Choose the Right Account

With $100, your best investment options are:

1. Brokerage Account

A brokerage account lets you buy:

- Stocks

- ETFs (exchange-traded funds)

- Index funds

Many platforms today have:

- No account minimums

- No commission fees

- Fractional shares (so you can invest less than the full stock price)

Examples include Fidelity, Vanguard, and Charles Schwab.

If you’re opening an account online, you can start here with a major brokerage like Fidelity.

2. Roth IRA (For Long-Term Retirement)

If you have earned income, a Roth IRA allows your money to grow tax-free for retirement. According to the IRS, qualified Roth IRA withdrawals in retirement are tax-free (IRS Roth IRA guide).

With $100, this can be a powerful long-term move.

Step 3: What Should You Invest in With $100?

Now the big question: what do you actually buy?

For investing for beginners, simplicity is powerful.

Option 1: Index Funds (Best for Most Beginners)

Index funds track the overall market. For example:

- An S&P 500 index fund tracks 500 large U.S. companies.

- It provides instant diversification.

Instead of betting on one company, you’re investing in hundreds at once.

This reduces risk compared to buying a single stock.

Examples include:

- Vanguard S&P 500 ETF (VOO)

- Fidelity ZERO Large Cap Index Fund (FNILX)

Option 2: Total Market ETFs

These funds invest in thousands of companies across the entire U.S. stock market.

This is often the simplest “set it and forget it” strategy.

Option 3: Fractional Shares of Strong Companies

With fractional investing, you can invest $25 into a $400 stock.

However, investing for beginners is usually safer with diversified funds rather than single stocks.

Step 4: Automate and Stay Consistent

Your first $100 matters less than what you do next.

The real power comes from:

- Investing every month

- Reinvesting dividends

- Avoiding emotional decisions

Even investing:

- $25 per week

- $50 per month

Can add up significantly over time.

Investing for beginners becomes much easier when you automate contributions.

Most brokerage platforms allow automatic deposits from your bank account.

Step 5: Understand Risk (Without Fear)

All investing involves risk. The stock market goes up and down.

But historically, long-term investors in broad market funds have seen positive returns over decades. The Federal Reserve provides long-term data showing how markets trend upward over extended periods despite short-term volatility.

Important mindset tips:

- Don’t panic during market drops.

- Don’t chase “hot stocks.”

- Think in years, not weeks.

Investing for beginners is about discipline, not speed.

Common Mistakes Beginners Should Avoid

1. Waiting Too Long

Trying to “learn everything” before investing can delay years of growth.

2. Investing Without a Plan

Know your goal:

- Retirement?

- Long-term wealth?

- Financial independence?

3. Checking Your Account Daily

Markets fluctuate daily. Long-term investors don’t obsess over short-term changes.

4. Ignoring Fees

Expense ratios and hidden fees reduce returns over time. Always review fund costs.

[IMAGE: Person reviewing investment portfolio calmly while market chart fluctuates]

Alt text: investing for beginners staying calm during market volatility

What Can $100 Really Turn Into?

Let’s run a realistic example.

If you invest:

- $100 today

- Add $100 per month

- Earn 8% annually

- For 30 years

You could end up with over $150,000.

That’s not hype — that’s compound growth and consistency.

Investing for beginners isn’t about turning $100 into $10,000 overnight. It’s about building wealth slowly and reliably.

A Simple Beginner Investment Plan (Step-by-Step)

If you want the easiest possible path:

- Open a brokerage account or Roth IRA.

- Deposit your first $100.

- Buy a low-cost S&P 500 index fund.

- Set up automatic monthly contributions.

- Ignore short-term noise.

- Stay invested for years.

That’s it.

No day trading.

No complex strategies.

No guessing.

When Should You Consider Something More Advanced?

After you:

- Have 6 months of expenses saved

- Are consistently investing

- Understand basic market principles

Then you might explore:

- Diversifying internationally

- Adding bond funds

- Learning about asset allocation

Final Thoughts on Investing for Beginners

Investing for beginners doesn’t require a lot of money. It requires:

- A small start

- A simple plan

- Long-term patience

Your first $100 is more than money — it’s momentum.

At FluentMoney, we believe financial confidence starts with action. The sooner you begin, the more powerful your results can be over time.

Next Steps

- Open a brokerage or Roth IRA account.

- Invest your first $100 in a diversified index fund.

- Set up automatic monthly contributions.

- Continue learning about personal finance.

And most importantly — start today.